Regulations 2019 and Service Tax Persons Exempted From Payment of TaxAmendment Order 2019 were gazetted and scheduled to take effect from 1 January 2020 onwards. The regulations entered into force on 1 September 2019.

AN ACT to amend the Communications Service Tax Act 2008 Act 754 to provide for an increase in the tax rate and for related matters.

. SERVICE TAX PERSONS EXEMPTED FROM PAYMENT OF TAX ORDER 2018 112019. With the approval from the GST council in the meeting held on January 10 2019 the changes made by the CGST Amendment Act 2018 IGST Amendment Act 2018 UTGST Amendment Act 2018 and GST Amendment Act Compensation to States 2018 along with the corresponding. Payment of Tax Amendment Order 2019.

In exercise of the powers conferred by section 164 of the Central Goods and Services Tax Act 2017 12 of 2017 the Central Government hereby makes the following rules further to amend the Central Goods and Services Tax Rules 2017 namely-. Central Board of Excise and Customs CBEC is a part of the Department of Revenue under the Ministry of Finance Government of India. Ad Always Free Fed Simple Always Right.

Amendments to Service Tax. Department of the TreasuryInternal Revenue Service. Service Tax is exempted for services occurring on 31 December 2021 and ending 1 January 2022.

AN ACT to amend the Communications Service Tax Act 2008 Act 754 to provide for an increase in the tax rate and for related matters. The Insolvency and Bankruptcy Code Amendment Act 2019 was implemented to accelerate the insolvency resolution process and ensure timely. Short title and commencement 1.

Effect of change in taxable service Transitional issues provision of. 2 This Act comes into operation on a date to be appointed by. This is why you remain in the best website to see the unbelievable books to have.

On 30 August 2019 the Service Tax Amendment Regulations 2019 the regulations providing certain amendments to the Service Tax Regulations 2018 the principal regulations were gazetted. 2 This Act comes into operation on a date to be appointed by. Among various changes the amending regulations include new rules for calculating the value of services where payment is made through any machine or device.

Short title and commencement 1. Pursuant to the Service Tax Amendment Bill 2019 foreign registered persons providing digital services to consumers in the country will need to pay service tax. 1This Act may be cited as the Service Tax Amendment Act 2019.

In addition to the introduction of Service Tax on digital services provided by foreign service providers refer to article in Indirect Tax News Issue 32019 - October 2019 the scope of taxable services subject to Service Tax has been expanded. By admin for NEWS UPDATES 07122020. Ad Download or Email IRS 1040X More Fillable Forms Register and Subscribe Now.

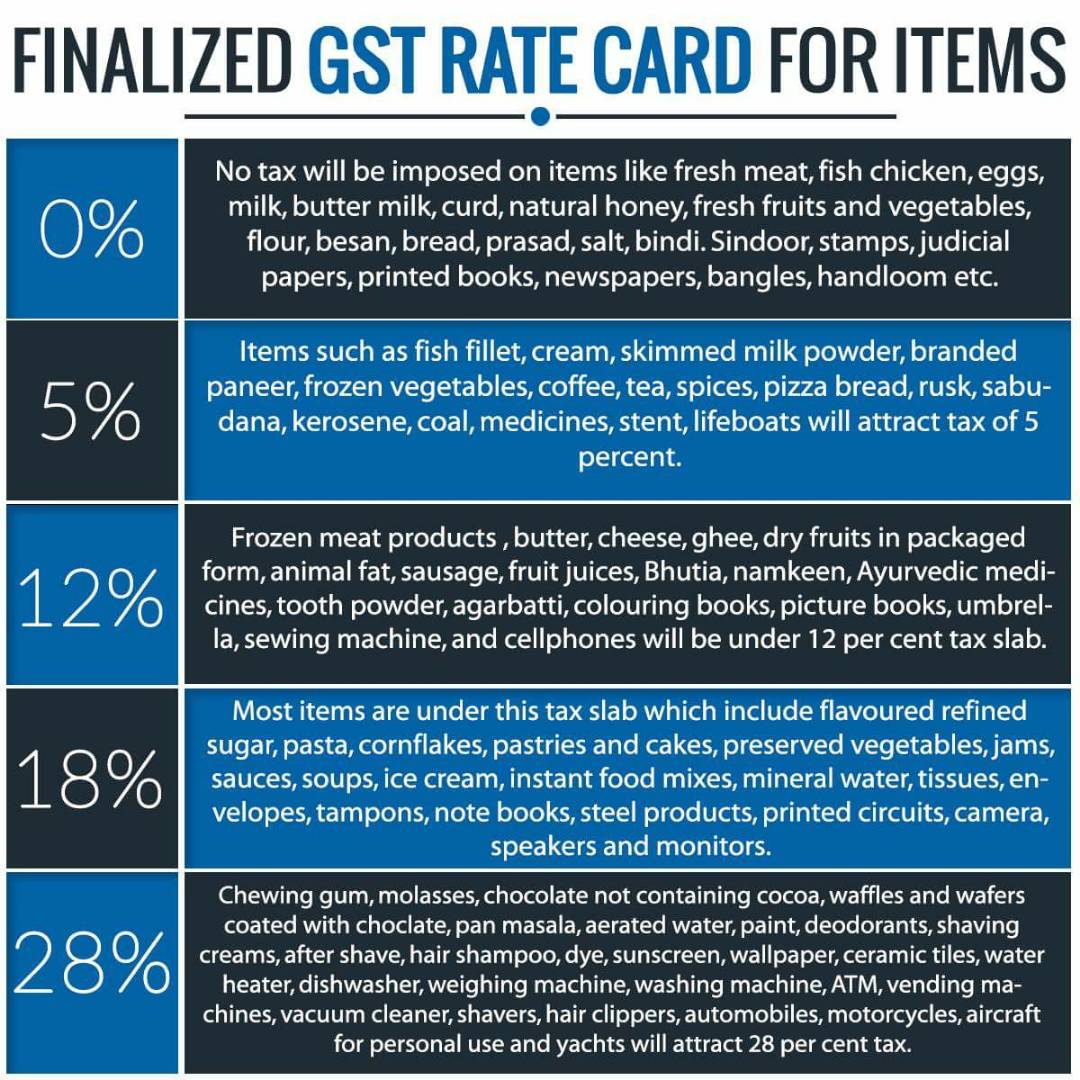

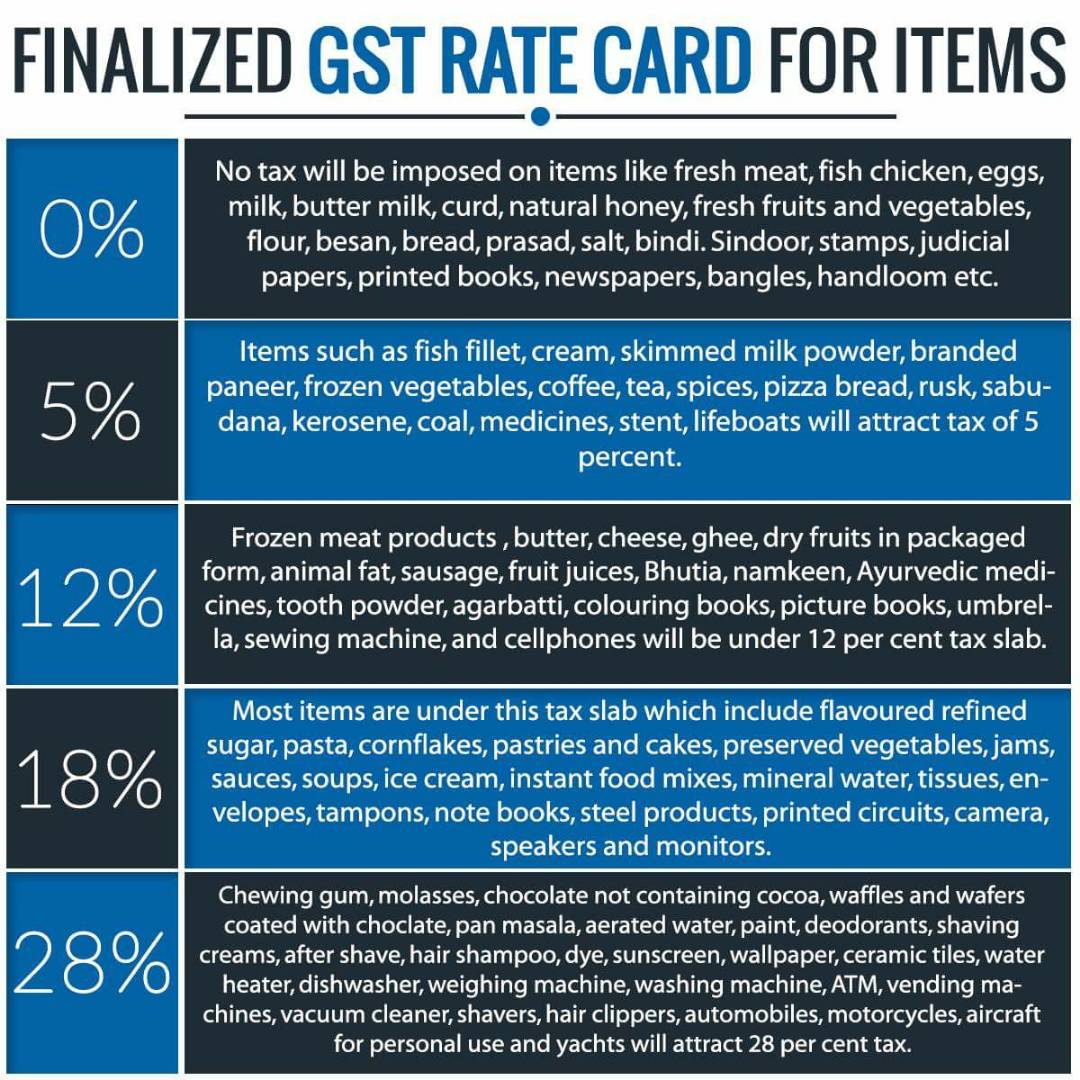

Changes in Goods Service Tax applicable from 1st October - 2019. Central Goods and Services Tax Amendment Rules 2019 Tina Saha GST-Goods and Service Tax April 23 2020 The Central Government vide Notification No. A The exemption is.

It deals with the tasks of formulation of policy concerning levy and collection of Customs Central Excise duties and Service Tax prevention of smuggling and administration of matters relating to Customs Central Excise. EXEMPTION FROM PAYMENT OF SERVICE TAX UNDER THE SERVICE TAX PERSONS EXEMPTED FROM PAYMENT OF TAX ORDER 2018. DS is any service delivered or subscribed over the internet or other electronic network that cannot be obtained without the use of information technology and where the delivery of the service is essentially.

Please be informed that effective 1st of January 2019 there will be amendments to service tax treatment as follows-. Section 2 1 of the Goods and Services Tax Act called in this Act the principal Act is amended by inserting immediately after the definition of account with the electronic service the following definitions. 1This Act may be cited as the Service Tax Amendment Act 2019.

New Delhi the 29th January 2019. COMMUNICATIONS SERVICE TAX AMENDMENT ACT 2019. Individual Income Tax Return.

Service Tax from 1 March 2019. Service Tax Amendment 3 LAWS OF MALAYSIA Act A1597 SERVICE TAX AMENDMENT ACT 2019 An Act to amend the Service Tax Act 2018. Ad Download or Email IRS 1040X More Fillable Forms Register and Subscribe Now.

Accountant means a public accountant within the meaning of the Accountants Act Cap. Through a guide on Service Tax Amendments 2019 issued on the MySST website has informed that Ministers exemption for imported taxable service in Group G professionals will be applicable to any company in Malaysia. ENACTED by the Parliament of Malaysia as follows.

Use this revision to amend 2019 or later tax returns. ENACTED by the Parliament of Malaysia as follows. Amendment to Service Tax Policy No.

PASSED by Parliament and assented to by the President. The regulations are dated 30 August 2019 and came into operation on 1 September 2019. Services provided or agreed to be provided by the State Government by way of grant of liquor licence against consideration in the form of licence fee or application fee or by whatever name it is called are proposed to be exempted from service tax for during the period.

Ad Complete IRS Tax Forms Online or Print Government Tax Documents. Exemption Section 343 By the Minister directly ie Letters issued by MoF. EXEMPTION FROM PAYMENT OF SERVICE TAX.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. THE CENTRAL GOODS AND SERVICE TAX AMENDMENT ACT 2018. Prepare File Prior Year Taxes Fast.

The introduction of the new Legal Profession Act 2018 to replace the old Legal Profession. July 2021 Amended US. Advocate and solicitor.

Favored books Latest Service Tax Amendments 2012 collections that we have. While some of the amendments made to the Regulations reflect the changes that were proposed in Budget 2020 a number of the changes were not. Section 1Section 3 of Act 754 amended The Communications Service Tax Act 2008 Act 754 referred to in this Act as.

Subject to meeting conditions Service Tax exemption on imported taxable services for companies in Labuan effective 1 September 2019 is now extended to 31 December 2021. Goods and Service Tax law in India has yet again seen slew of changes in the mid of financial year 2019-20. Finance No2 Bill 2019.

Always Free Always Simple Always Right. Service Tax Amendment 1 A BILL i n t i t u l e d An Act to amend the Service Tax Act 2018. Service Tax Rate increased to 15 wef 162016Krishi Kalyan Cess Added 05Service Tax Rates have changed from time to time as shown belowPeriodRate of Service TaxTill 31 May 20151236From 1 June 2015 to 14 Nov 201514From 15 November 2015 to 31 May 2016145From 1 June 201615Learn More.

The taxable person specified in. Prepare File Prior Year Taxes Fast. Under the Service Tax Amendment Act 2019 the service tax will be levied on digital services DS with effect from 1 January 2020.

2 Regulations 2019. The main amendments to the regulations are set out below. 2 Regulations 2019 the following services are subject to.

032019 Central Tax dated 29th January 2019 has amended CGST Rules 2017 details of. Under the Service Tax Amendment No. New York State Sales and Use Tax Law and Regulations As of January 1 2015 CCH State Tax Law Editors Staff 2015-03-15 New York State Sales and Use Tax Law and Regulations serves as a.

The Royal Malaysian Customs Department has published the Service Tax Amendment Regulations 2019. The Government will be taxing digital services beginning from Jan 1 2020 at 6 per annum.

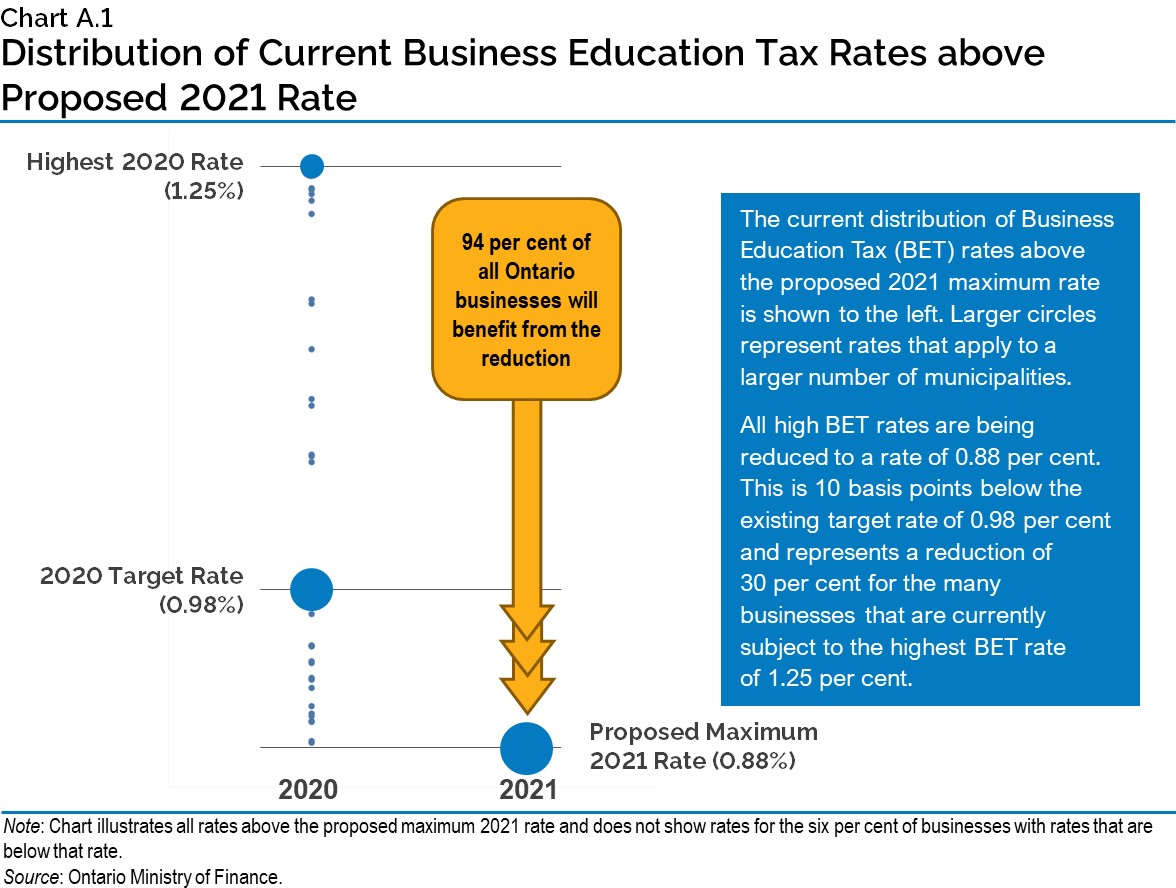

2019 Ontario Budget Chapter 1d

2019 Ontario Budget Chapter 1d

Dentons Global Tax Guide To Doing Business In Bolivia

Gst Amendments Vide Budget 2019 7 Major Points

Chapter 9 Tax Fairness And Effective Government Budget 2022

Tax News Alert Finance Act 2019 Pwc

Budget 2021 Proposed Gst Hst Amendments Mcmillan Llp

2019 Ontario Budget Chapter 1d

Canadian Tax News And Covid 19 Updates Archive

Company Registration Services Price List 2019

Ey Tax Alert 2022 No 27 Ontario Budget 2022 23 Ey Canada

Canadian Tax News And Covid 19 Updates Archive

Gst Tax Rate Chart For Fy 2017 2018 Ay 2018 2019 Goods And Service Tax Taxdose Com

:max_bytes(150000):strip_icc()/1040-X2021-1f84c7ebdea2461ba2f7d9de9c6cb8ec.jpeg)

Form 1040 X Amended U S Individual Income Tax Return Definition

2019 Ontario Budget Chapter 1d

Chapter 9 Tax Fairness And Effective Government Budget 2022